Retirement Income Planning - Questions

Table of ContentsRumored Buzz on Retirement Income PlanningGetting My Retirement Income Planning To WorkExamine This Report on Retirement Income PlanningSome Known Details About Retirement Income Planning A Biased View of Retirement Income Planning

For example: People utilized to say that you require about $1 million to retire conveniently. Various other professionals use the 80% guideline, which specifies that you need sufficient to survive on 80% of your income at retirement. If you made $100,000 per year, after that you would require cost savings that could produce $80,000 per year for roughly 20 years, or a total of $1.

And given that you'll have much more downtime on your hands, you might additionally want to consider the expense of entertainment as well as travel. While it might be tough to find up with concrete figures, be sure ahead up with a sensible quote so there are not a surprises later.

Not known Details About Retirement Income Planning

Look at your financial investments once in a while and also make routine modifications. It's always an excellent suggestion to make any kind of modifications whenever there's a change in your way of living and when you get in a various stage in your life. Retired life accounts been available in numerous sizes and shapes. The rules and also policies for each might be different.

You can and also ought to add greater than the quantity that will gain the employer suit. As a matter of fact, some specialists recommend up of 10%. For the 2022 tax year, individuals under age 50 can contribute as much as $20,500 of their revenues to a 401(k) or 403(b), a few of which might be additionally matched by an employer.

This means that the money you save is deducted from your earnings prior to your tax obligations are taken out. It decreases your taxed income as well as, as a result, your tax obligation responsibility., spending in a traditional Individual retirement account can knock you down to a reduced one.

When it comes time to take circulations from the account, you are subject to your typical tax price at that time. Maintain in mind, though, that the cash grows on a tax-deferred basis.

Indicators on Retirement Income Planning You Need To Know

Distributions need to be taken at age 72 and can be taken as early as 59. You are subject to a 10% charge if you make withdrawals before that.

This removes the prompt tax reduction yet avoids a more significant earnings tax bite when the money is withdrawn at retirement. Starting a Roth IRA early can pay off huge time in check over here the long run, even if you don't have a great deal of money to spend at.

Roth IRAs have some limitations. The contribution limit for either IRA (Roth or traditional) is $6,000 a year, or $7,000 if you are over age 50. Still, a Roth has some income limits: A single filer can add the complete amount just if they make $125,000 or much less each year, since the 2021 tax obligation year, and $129,000 in 2022.

The STRAIGHTFORWARD IRA is a pension supplied to workers of tiny businesses read this instead of the 401(k), which is pricey to preserve. It works similarly a 401(k) does, enabling employees to conserve money automatically through payroll reductions with the choice of an employer suit. This amount is capped at 3% of a staff member's yearly salary.

Examine This Report about Retirement Income Planning

Catch-up payments of $3,000 permit staff members 50 or older to bump that limit up to $17,000 - retirement income planning. When you established up a retired life account, the question becomes just how to direct the funds.

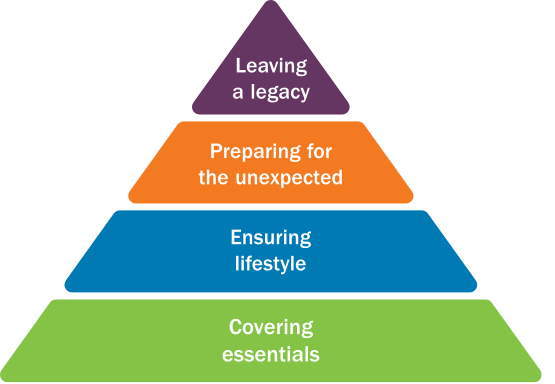

Below are some guidelines for effective retired life preparation at various phases of your life., which is an check essential and also valuable piece of retirement savings.

Even if you can only put aside $50 a month, it will be worth three times more if you invest it at age 25 than if you wait to start investing until age 45, thanks to the joys of compounding. You may be able to invest more cash in the future, yet you'll never ever have the ability to offset any type of lost time.

Nevertheless, it's important to proceed conserving at this stage of retirement planning. The mix of making more money and the moment you still need to invest and earn interest makes these years some of the ideal for hostile cost savings. People at this stage of retired life preparation ought to continue to capitalize on any kind of 401(k) matching programs that their employers offer.

The Definitive Guide for Retirement Income Planning

For those disqualified for a Roth individual retirement account, think about a traditional IRA. Similar to your 401(k), this is funded with pretax bucks, as well as the properties within it grow tax-deferred. Some employer-sponsored strategies offer a Roth choice to reserve after-tax retired life contributions. You are limited to the very same annual limit, however there are no income restrictions similar to a Roth IRA.